Our Services

Beach Front Claims Public Adjusters offer their expert services across the entire state of Florida.

did you know ?

Having a public adjuster on your side can lead to significantly higher compensation for insurance claims, even after accounting for their fees? According to a recent study by the Office of Program Policy Analysis & Government Accountability, the average payment for hurricane claims in Florida was 747% higher when a public adjuster was involved. That’s the difference between a financial band-aid and total recovery from personal loss. Don’t leave money on the table – consider working with a public adjuster for your next insurance claim.

Denied Claims & Under Paid Claims

In Florida, underpaid and denied insurance claims are unfortunately all too common. It’s crucial to understand that a denial or underpayment from your insurance company doesn’t signify the end of the road. In fact, many of our successful claims initially faced denial or underpayment. At Beach Front Claims, we specialize in turning around such situations, ensuring that your rightful compensation is not overlooked or underestimated.

Storm Damage

In Florida, homes and businesses are vulnerable to a variety of storm damages due to natural disasters such as hurricanes and tornadoes. Possible storm damages include:

- Wind Damage: High winds can tear off roofing materials, break windows, and damage exteriors.

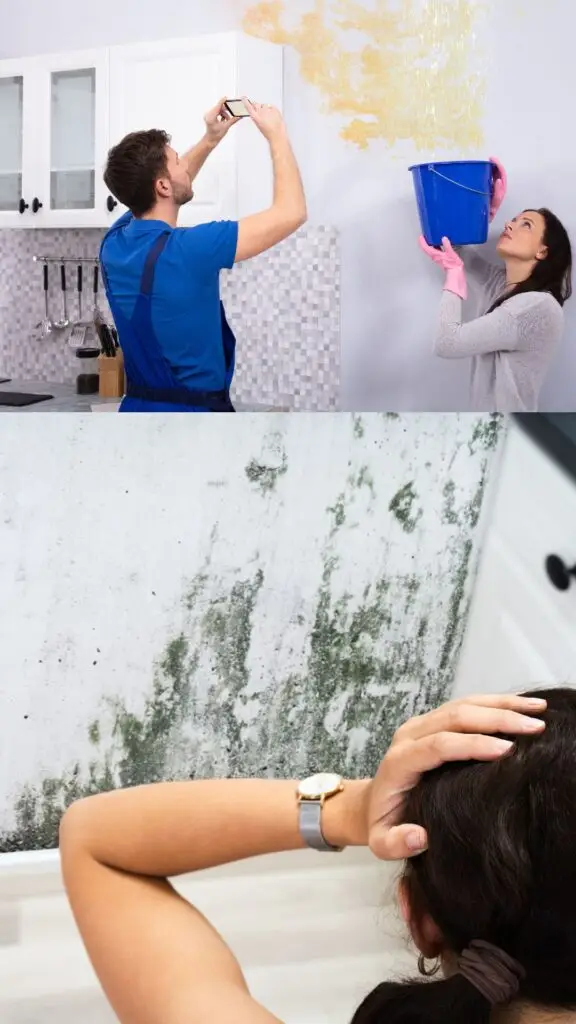

- Water Damage: Heavy rains and flooding can lead to water intrusion, damaging floors, walls, and furniture.

- Structural Damage: The intense pressure and force from storms can weaken or compromise building structures.

- Electrical Damage: Storms can cause power surges, damaging electrical systems and appliances.

- Fallen Trees and Debris: High winds can topple trees and hurl debris, causing damage to buildings and vehicles.

- Roof and Siding Damage: Shingles and siding can be ripped away, leading to leaks and water damage inside.

- Mold and Mildew: Post-storm moisture can create conditions ripe for mold and mildew growth, affecting air quality and health.

Understanding these potential damages is crucial for Florida residents and businesses to prepare and respond effectively. As public adjusters, we’re here to help navigate the insurance claims process for all types of storm-related damages.

Marine & Maritime Salvage

In Florida, where boating is a popular activity, vessels are susceptible to various types of damage, especially considering the state’s frequent storms and hurricanes. As public adjusters specializing in maritime claims, we’re adept at handling damages such as:

- Storm Damage: Hurricanes and tropical storms can cause significant harm to boats, from hull breaches to torn sails.

- Collision Damage: Accidents with other vessels or stationary objects like docks can result in structural damage to the boat.

- Water Damage: Flooding from breaches or heavy rains can damage the boat’s interior, electrical systems, and engine.

- Wind Damage: Strong winds can snap masts, tear sails, and dislodge fittings and fixtures.

- Corrosion and Saltwater Damage: Continuous exposure to saltwater can corrode metal components and degrade the boat’s integrity.

- Sun Damage: Prolonged exposure to the Florida sun can fade paint, crack the hull’s surface, and deteriorate seating materials.

- Theft and Vandalism: Boats are at risk of theft and vandalism, leading to loss of equipment and damage to the vessel itself.

- Grounding Damage: Running aground can cause severe damage to the hull, potentially leading to leaks or total loss.

Understanding these potential risks is crucial for boat owners in Florida. Our team at Beach Front Claims is equipped to navigate the complexities of maritime claims, ensuring boat owners receive fair compensation for their losses.

Fire Damage

Our team boasts over 30 years of firefighting expertise, covering roles from Fire Officer to Arson Investigator and Naval Shipboard Firefighting. Let our seasoned professionals assist you.

Here’s a simplified fire claim documentation checklist:

- Document Damage: Capture photos or videos of the fire damage for visual evidence.

- List Damaged Items: Record all damaged or lost items, noting make, model, and replacement costs.

- File a Police Report: If arson or criminal activity is suspected, file a report.

- Gather Insurance Details: Collect your policy number, coverage details, and insurer contact info.

- Mitigate Further Damage: Secure your property to prevent additional damage, like boarding up windows.

- Save Receipts/Invoices: Keep all related receipts and invoices, including for temporary accommodations and repairs.

- Record Insurer Communications: Log all interactions with your insurance company, noting names, dates, and details.

Proper documentation is key to a successful fire insurance claim. For guidance through the claims process, contact Beach Front Claims.

Appraisal

An insurance appraisal provides an impartial, confidential evaluation of property value or damage, aiding in the resolution of disputes between insured parties and insurers. Its advantages include:

- Impartiality: Delivers fair assessments by an independent third party.

- Efficiency: Accelerates the resolution of claim disputes, bypassing lengthy litigation.

- Cost-Effectiveness: Offers a more economical alternative to court proceedings.

- Confidentiality: Ensures the privacy of the appraisal process.

- Expertise: Utilizes experienced professionals for precise evaluations.

- Finality: Results in a binding decision, facilitating prompt settlement.

This method streamlines dispute resolution through expert, unbiased appraisals, reducing the need for costly and time-consuming legal action.

Frequently Asked Questions

An insurance appraisal offers impartiality through fair assessments by an independent third party, efficiency in resolving disputes quickly, cost-effectiveness compared to court proceedings, confidentiality of the process, expertise from experienced professionals, and finality with a binding decision for prompt settlement.

Insurance appraisals provide a more efficient and cost-effective method for resolving claim disputes by utilizing expert, unbiased evaluations to reach a binding decision, significantly reducing the need for lengthy and expensive litigation.

Our team offers over 30 years of firefighting expertise, including roles such as Fire Officer, Arson Investigator, and Naval Shipboard Firefighting, ensuring seasoned professionals assist you through the claims process.

For effective fire claim documentation, capture photos/videos of damage, list all damaged items with details, file a police report if needed, gather insurance information, mitigate further damage, save all receipts/invoices, and record all insurer communications.