California is once again facing an intense wildfire season, with both residential and commercial properties at risk, especially in areas prone to drought, heatwaves, and high winds. Wildfires have been a long-standing issue for the state, but recent years have seen a marked increase in the size, frequency, and intensity of these fires. Here’s a breakdown of what’s going on in California with wildfires and their impact on homes:

Historical Context: Over the past decade, California has experienced record-breaking wildfires. The fires in 2020, 2021, and 2022 were some of the largest in state history. The fires have destroyed thousands of homes, communities, and acres of land.

2023 and Beyond: The 2023 season continued the trend, with an increased number of fires driven by hotter temperatures, drier conditions, and less rainfall due to climate change. In fact, California has witnessed some of the largest and most destructive wildfires in recent memory, including ones in areas like Napa Valley, Los Angeles County, and the Sierra Nevada foothills.

Rising Premiums and Denied Claims: As the risk of wildfire increases, home insurance premiums in fire-prone areas of California have surged. In some cases, insurers are denying coverage or dropping policyholders entirely, particularly in high-risk zones.

Lack of Availability: Some homeowners in high-risk wildfire areas find it difficult to secure affordable or comprehensive homeowners insurance. Companies are increasingly hesitant to offer coverage due to the rising cost of wildfire-related claims.

State Efforts: In response, the state has introduced programs like the California FAIR Plan, which provides basic fire insurance to homeowners who cannot obtain it in the private market. However, the FAIR Plan often offers limited coverage and does not include all perils (like theft or vandalism).

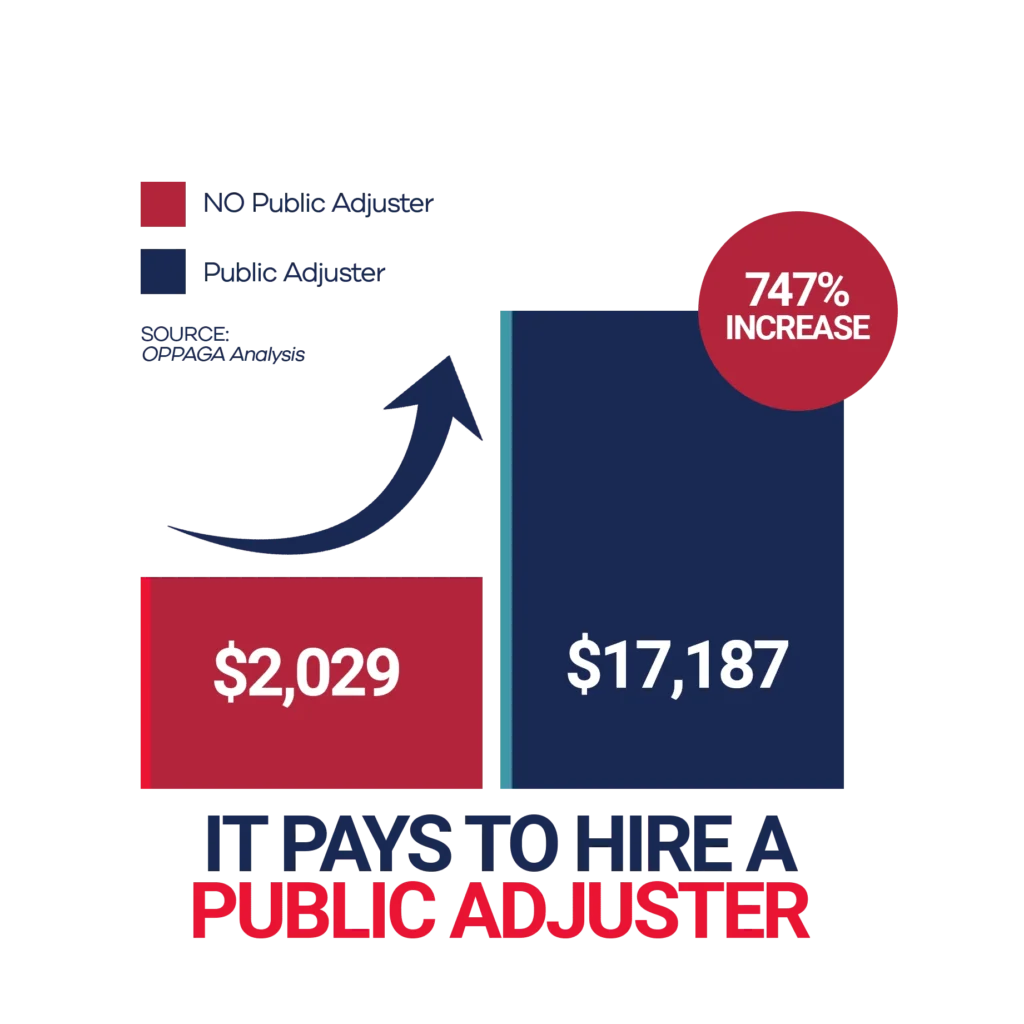

A public adjuster is your advocate, working to ensure that you receive the full benefits of your policy. They can be especially helpful if your claim has been denied, as they will re-evaluate the claim, gather additional evidence, and negotiate directly with the insurance company on your behalf.

— National Association of Public Insurance Adjusters (NAPIA)

Before thinking about your property, make sure you and your loved ones are safe. Wildfires can move quickly, and your primary concern should always be your well-being.

Once you’ve ensured your safety, it’s time to assess the damage. Wildfires can cause a variety of damages, including structural fires, smoke damage, soot damage, and water damage from firefighting efforts.

Here are some common types of damage you may encounter:

Make sure to document the damage with photos and videos. This will be important for both your insurance claim and any potential public adjuster involvement.

Once the immediate danger has passed, it’s time to contact your insurance company. Call your insurance provider to report the damage as soon as possible. The quicker you file a claim, the sooner the insurance company will begin the process of assessing your damage.

However, this is where things can get complicated. Insurance policies, especially when it comes to wildfire claims, are often full of jargon and exclusions that can make navigating the claims process tricky.

This is where a public adjuster can make a huge difference.

A public adjuster is an independent insurance professional who works on your behalf, not the insurance company’s. Unlike the adjusters hired by your insurance provider, a public adjuster represents your interests and ensures you’re getting a fair settlement for your property damage.

Navigate the complexities of filing an insurance claim with ease. Our expert advice guides you through every step, ensuring a smooth process and maximizing your settlement.

A public adjuster is a licensed insurance professional who works on your behalf, not for the insurance company. They help you assess your damages, file your claim, and negotiate with the insurer to ensure you receive the maximum settlement possible. After a wildfire, they can guide you through the complex claims process and ensure no damage is overlooked.

If you have suffered significant damage to your property, or if you feel that your insurance company’s settlement offer is too low, a public adjuster can help. They can evaluate the full extent of the damage, ensure your policy coverage is properly applied, and negotiate a better settlement on your behalf.

Start by contacting your insurance company to report the damage. Document everything with photos and videos. A public adjuster can help you throughout this process by ensuring you’ve documented all aspects of the damage, reviewing your policy, and guiding you through the paperwork. They will handle the details of the claim, leaving you with one less thing to worry about.